Australia wine equalisation tax pdf

The Turnbull Government today announced enhancements to the Wine Equalisation Tax (WET) Rebate to better assist grape growing, winemaking and associated tourism in regional Australia.

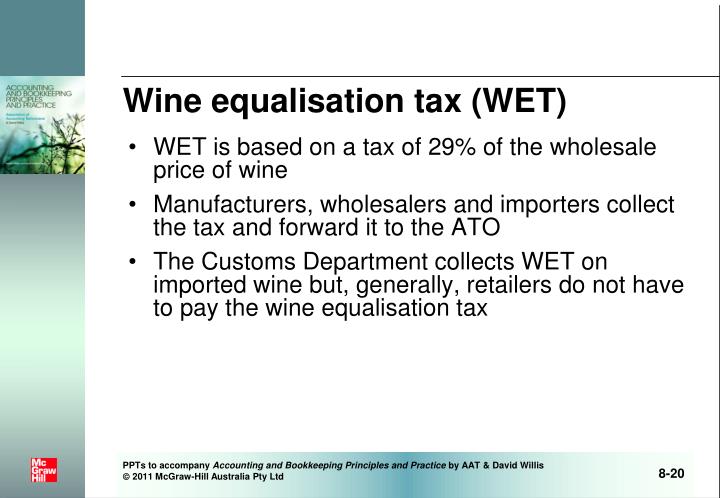

The Wine Equalisation Tax (wine tax) is a value-based tax applying to wine consumed in Australia. It applies at a rate of 29 per cent to assessable dealings in wine which include wholesale sales, sales under quote [3] and applications to own use. [4]

The grant is part of a coordinated suite of measures developed with the Australian grape and wine community after extensive consultations on reforms to the Wine Equalisation Tax (WET) rebate arrangements. It complements the components of the Package, which are being implemented from 2018 to …

Wine Equalisation Tax Rebate Thank you for the opportunity to provide a submission to The Treasury’s review of the Wine Equalisation Tax rebate. We welcome the current review of Australia’s taxation system, and believe there is substantial scope to improve tax arrangements to better reflect and minimise the burden of illness, injury and social and economic harms caused by alcohol. Surgeons

Australia has a world-class wine industry which provides a wide range of wines to consumers across Australia and around the world, but the increasing reliance on high-volume, low-value and water-intensive wine production is the source of several problems.

Click here if you are having trouble viewing this message. September 2016 Proposed Wine Equalisation Tax (WET) rebate reform a dampener to Australian wine industry confidence

The Wine Equalisation Tax (WET) is a complex tax that is applied at a high rate to a large number of transactions. Because WET is applied at a high rate to a large number of transactions, a small WET overpayment on each transaction can translate into a big WET overpayment. Wine equalisation tax …

Wine is subject to the wine equalisation tax, which is based on the value of the wine. Rebates are available to small producers. Rebates are available to small producers. The result is that very different amounts of tax are payable on a standard drink depending on beverage type, alcohol concentration, container size, size of producer and the pre-tax price of the product.

1 The WET was introduced by the A New Tax System (Wine Equalisation Tax) Act 1999. 2 A New Tax System (Wine Equalisation Tax) Act 1999: Second reading …

A better, simpler, fairer wine tax system for a stronger Australian wine industry Pernod Ricard Winemakers Submission on Indirect taxes – Alcohol tax Changing the Wine Equalisation Tax to help restructure and restore profitability to the Australian wine industry. June 2015 . Executive Summary The Australian wine industry has enjoyed global success and has the potential to recapture and

The Auditor-General Audit Report No.20 2010-11 Performance Audit Administration of the Wine Equalisation Tax Australian Taxation Office Australian National Audit Office

For example, you could create a GW tax code (with a 41.9% tax rate) that is composed of WET (Wine Equalisation Tax) at 29% and WEG (GST on Wine Equalisation Tax) at 12.9%. Make sure you first create the tax codes you want to consolidate.

The introduction of a Goods and Services Tax (‘GST’) in Australia has already had a profound impact on many sectors of the economy that now have to understand and operate within the complexities of this new system of indirect taxation in Australia.

On 5 May 2015 the Assistant Treasurer announced the release of a discussion paper on the wine equalisation tax rebate (WET rebate). This discussion paper forms part of the Tax White Paper process. The next step in this process is the release of a Green Paper in the second half of 2015. Further community consultation on possible reforms to improve the tax system will follow, with a …

Australia is consistently among the top 10 wine-producing countries in the world and is one of the few countries that produces every major wine variety. Two-thirds of Australian wine is exported, valued at .4 billion per year.

Wine Equalization Tax (WET) at the wholesale level. The WET was so called because, by setting it at 29 The WET was so called because, by setting it at 29 percent, it together with the GST generated about the same tax revenue for the government as the former

How the Wine Equalisation Tax works Added July 6, 2013 When the goods and services tax was introduced on to the Australian tax landscape in 2000, there was a lot of angst about the negative effect on the cost of living that this blanket 10% impost would have.

Wine Equalisation Tax (WET) is a tax on wine levied at 29% of the taxable value of wine. The taxing point is the last wholesale sale, or a retail sale or application for own use (e.g. tastings) when there is …

WET Wine Equalisation Tax WHO World Health Organization YLL years of life lost. ix Executive summary Alcohol abuse in Australia is a serious problem whose social costs in 2004/05 have been estimated to be over billion. The present study estimates the extent to which these costs could be reduced by the implementation of appropriate public policy interventions. It indicates that it should be

How the Wine Equalisation Tax works Lewis Accountants

Wine tax increase Australia’s cheap wines to cost more

The Wine Equalisation Tax (WET) legislation changes were agreed by the Australian Parliament on 17 August 2017 and are now law, known as the Treasury Laws Amendment (2017 Measure No.4) Act 2017. Winemakers who currently access the rebate, or sell grapes to a wine producer who receives the rebate, will need to understand the implications of the changes.

CONSIGN WINE EQUALISATION TAX TO HISTORY For immediate distribution 3 September 2015: As momentum gathers for change to Australia’s flawed alcohol tax regime, new

Proposed wine equalisation tax (WET) rebate reform Agribusiness Earlier this year we highlighted signs that the Australian wine industry, driven by a boost in export sales, was beginning to reverse the trend of the testing times that it has endured for so long.

2/2 These changes will reduce the incentive for rorting and will strengthen the long-term prospects of Australian wine producers and ensure ongoing investment in the wine industry, and particularly

The Australian Government has introduced legislation to improve the integrity of the wine equalisation tax rebate and better target support to small wine producers in rural and regional Australia.

This is a reprint of the Taxation (Australian Wine Equalisation Tax Rebate) Regulations 2006. The reprint incorporates all the amendments to the Taxation (Australian Wine Equalisation Tax Rebate) Regulations 2006 as at 1 April 2008, as specified in the list of amendments at the end of these notes.

Wine Equalisation Tax Changes. The Buzz Is OUT NOW! Parliament last week passed the Treasury Laws Amendment (2017 Measures No. 4) Bill 2017.

The issue The WET rebate was originally intended to support small wine producers in rural and regional Australia. However, it has encouraged business structuring to maximise rebate claims.

The wine equalisation tax (WET) is a value-based tax paid on certain dealings with wine sold in Australia. These dealings are: These dealings are: wholesale sales where WET is paid on the selling price of the wine at the last wholesale sale (excluding WET and goods and services tax)

Resource of Australian Tax and Accounting materials, including Legislation, Rulings, Cases, Commentary, Practice Aids and News. Resource of Australian Tax and Accounting materials, including Legislation, Rulings, Cases, Commentary, Practice Aids and News

Wine equalisation tax (WET) is a tax on wine consumed in Australia. It is based on the value of the wine and generally applies to the last wholesale sale (usually between the wholesaler and the retailer) although it may apply in other circumstances.

Wines of Western Australia Wine Equalisation Tax Position Paper August 2016 Table of Contents Page Executive Summary 1 Wines of WA Wine Equalisation Tax Position Paper Executive Summary In the 2016 Federal Budget, the Government announced changes to the WET Producer Rebate (WET Rebate). Wines of WA (WoWA) supports the policy objectives behind the changes, …

tax agressiveness of alcohol and bottling companies in australia 7 Tax planning is a term mainly used in Australia and Europe research literature and usually refers to an aggressive form of tax …

Submission to the Treasury Discussion Paper on the Wine

Wine equalisation tax (WET) is a value-based tax on wine consumed in Australia. WET applies at 29% of the value of the wine at the last wholesale sale (before adding goods and services tax (GST)). Don’t complete the WET section of your activity statement if you report and pay GST using a pre-printed instalment amount (option 3 on the activity statement) because we have included your WET in

Australian Grape and Wine Authority Economic Contribution of the Australian Wine Sector By way of example of the quantum of tax paid by the wine sector, net Wine Equalisation Tax payments were 2 million in 2014-15 and are forecast to increase to 0 million by 2018-19 (Australian Government, December 2015). Input-Output analysis has shown that the average effects of a …

BACKGROUND C ONTEXT The wine industry is an important contributor to the Australian economy, employing around 30,000 people directly and many more indirectly.

Wine equalisation tax (WET) applies to wine manufacturers, wholesalers, and importers. WET is a tax of 29% of the wholesale value of wine. It is only payable if you are registered or …

The Federal Government says its wine equalisation tax (WET) reforms will save 0 million over four years, and it will give million of that to the Australian Grape and Wine Authority to

The A New Tax System (Wine Equalisation Tax) Act 1999 (WET Act) deals with tax on sales, importations and certain other dealings with wine which take place on or after 1 July 2000. The tax on wine is referred to in this Ruling as the wine tax although it is also known as the wine equalisation tax …

Wine Equalisation Tax – Australian Government. Description. You will generally be required to pay Wine Equalisation Tax (WET) if you: make wine or import wine for consumption in Australia; sell wine by wholesale. WET is a value based tax of 29% which generally applies (unless eligible for an exemption) on the last wholesale sale of wine, usually between the wholesaler and the retailer. You …

grape wine products (such as marsala) fruit wines and vegetable wines cider and perry (although, WET doesn’t apply to all cider and perry) mead sake. – liebherr grand cru wine fridge manual Wine equalisation tax is a tax on the last wholesale sale (that is,a sale to a reseller) of wine in Australia.For the purposes of the tax,wine includes grape wine,grape wine products such as marsala,vermouth,wine cocktails and

This is a compilation of the A New Tax System (Wine Equalisation Tax) Act 1999 that shows the text of the law as amended and in force on 1 October 2017 (the compilation date). The notes at the end of this compilation (the endnotes) include information about amending laws and the amendment history of provisions of the compiled law. Uncommenced amendments. The effect of uncommenced …

Under the Wine Equalisation Tax (WET), wine is taxed at 29 per cent of its wholesale value, and a tax rebate of up to 0,000 is available to wholesalers. Under the changes, the rebate will be

Print entire document z Wine equalisation tax If you make wine, import wine into Australia or sell it by wholesale, you’ll generally have to account for wine equalisation tax (WET). WET is a tax of 29% of the wholesale value of wine. It is only payable if you are registered or required to be registered for GST. It’s designed to be paid on the last wholesale sale of wine, which is usually

Wine equalisation tax rebate The Government has released exposure draft legislation and associated explanatory material that would amend the A New Tax System (Wine Equalisation Tax) Act 1999 to give effect to the reforms to the wine equalisation tax (WET) rebate announced on 2 December 2016.

This Supplementary Order Paper amends the Taxation (Annual Rates and Urgent Measures) Bill, to enable the Inland Revenue Department to tax and assist in the administration of Australian wine producer rebates payable by the

Getting back to basics with WET. Winemakers’ Federation of Australia (WFA) has been inundated in recent months with inquiries from our members on aspects relating to the Wine Equalisation Tax …

Wine Equalisation Tax New Measures Australia o intend to sell wine by any kind of sale if you are mainly a wholesaler o intend to use the wine as a material in manufacture or other treatment or processing o intend to make a GST-free supply of the wine •Quote must be made at or before the time of the dealing •Can be for each purchase or for a period up to one year (periodic

Wine is taxed differently to other alcoholic beverages in Australia. It has its own tax, the Wine Equalisation Tax (WET).[1] The WET is imposed at the rate of 29 per cent on the wholesale value of wine.[2] All other alcoholic beverages are taxed on their alcohol content.[3] This generally makes the

Australia is the fifth largest wine producer in the world, and the largest in the Southern hemisphere, with a total vineyard area of around 135,000 hectares. 6 In 2017, total wine production in Australia was around 1.2 billion litres per year.

PSPBORD305A Calculate taxes, fees and charges Modification History Release TP Version Comments 3 PSP12V1 Unit descriptor edited. 2 PSP04V4.2 Layout adjusted.

Using the Wine Equalisation Tax rebate to build a stronger

Wine Equalisation Tax (WET) – a value based tax that applies on the last wholesale sale of wine, usually between the wholesaler and the retailer. Table 1. Summary of alcohol taxes applied by category of alcohol product [3]

The Australian wine sector recorded its third consecutive increase in crush and the average purchase price of winegrapes this year, according to the National Vintage Report 2017 released today by Australian Vignerons, Wine Australia and the Winemakers’ Federation of Australia.

Decrease in Wine Equalisation Tax (WET) rebate; extension of excise refund scheme WET amendments. Responding to calls from the industry for reform, changes to the wine equalisation tax (WET) will be introduced in an attempt to strengthen the reputation of Australia’s wine industry.

Department of Agriculture and Water Resources Wine

Wine Equalisation Tax (WET) PS Help Tax – Australia

Wine equalisation tax is a tax imposed on wine made, imported, exported or sold by wholesale in Australia. It is applied at 29% of the wholesale value of wine.

added in (and Wine Equalisation Tax for wine), and (b) freight and transport costs to Australia. If you would like to receive more specific information on the taxes payable, you can go into the Customs website at www.customs.gov.au, or alternately send Customs an Email enquiry at

The Tourist Refund Scheme (TRS) is part of the Australian Government’s tax system. The TRS allows Australians and overseas visitors to claim a refund, (subject to certain conditions), of the goods and services tax (GST) and wine equalisation tax paid on goods bought in Australia and then taken out of Australia.

Wine Equalisation Tax (WET) rebate. Such measures have been the subject of ‘in principle’ Such measures have been the subject of ‘in principle’ agreement between the Federal Government and the Australian wine industry.

Regional consequences in Australia of wine export demand

Grants and how to apply Wine Australia

Wine equalisation tax (WET) is a once-off tax on certain wine transactions in Australia. WET is generally payable on the last wholesale sale of the wine (usually between the wholesaler and the retailer) and is based on the value of the wine.

The South Australian Wine Industry Association supports the Winemakers’ Federation of Australia proposals for change. Wine Equalisation Tax Rebate Submission

Wine Equalisation Tax. Wine Equalisation Tax (WET) is a tax on wine consumed within Australia and is levied at 29%. The tax is paid on the value of the wine at the last wholesale sale, or an equivalent value when there is no wholesale sale.

Submission on the exposure draft legislation to amend Wine Equalisation Tax Submission for the Wine Tourism & Cellar Door Grant. March Submission to the Container Refund Scheme (QLD) February

New Tax System (Wine Equalisation Tax and Luxury Car Tax Transition) Act 1999. Some of the most significant differences between the New Zealand and the Australian GST regimes arise in the context of the financial services sector. Those differences go primarily to the scope of what financial services are treated as input taxed/exempt supplies and to the availability of input tax credits

Using the Wine Equalisation Tax rebate to build a stronger and more profitable Australian wine industry Submission to Discussion Paper Treasury Wine Estates & Pernod Ricard Winemakers

producers who benefit from the wine equalisation tax rebate. There are approximately 100 distilleries in Australia who will be eligible for the scheme including many new whisky distillery start-ups in Tasmania. Budget impact The extended scheme is expected to cost m over the next four years. How an Australian craft distillery would benefit from the assistance Tasmanian XYZ Whisky uses local

The Government will ask the Treasury to prepare a discussion paper on the operation of the Wine Equalisation Tax (WET) rebate to help inform consideration of the issue as part of the Tax …

Within Tasmania, the Wine Equalisation Tax (WET) rebate is being utilised as was originally intended – to support small wine producers / cellar doors making a significant contribution to Australia…

In the 2016-17 Budget, the Government announced that it will address integrity concerns with the wine equalisation tax rebate and better target support to small wine producers in rural and regional Australia.

Wine equalisation tax rebate Tightened eligibility

equalisation tax (WET) rebate and better target support by reducing the WET rebate cap and tightening eligibility criteria. The Government will also provide more support for export and regional wine growers.’

As the tax is based on the wholesale price of wine rather than the volume of alcohol, it encourages the production, promotion and consumption of cheaper wine, which has flow-on impacts.

Australian Government The Treasury Exposure Draft

Wine equalisation tax rebate – Treasury.gov.au

days of wine and roses chords pdf – Tax Guide Wine Equalisation Tax – cetaceangroup.com.au

Thank you for the opportunity to provide a submission to

Travellers abf.gov.au

Taxation (Australian Wine Equalisation Tax Rebate

Decrease in Wine Equalisation Tax (WET) rebate extension

Supplementary Order Paper taxpolicy.ird.govt.nz

A better, simpler, fairer wine tax system for a stronger Australian wine industry Pernod Ricard Winemakers Submission on Indirect taxes – Alcohol tax Changing the Wine Equalisation Tax to help restructure and restore profitability to the Australian wine industry. June 2015 . Executive Summary The Australian wine industry has enjoyed global success and has the potential to recapture and

Wine equalisation tax is a tax imposed on wine made, imported, exported or sold by wholesale in Australia. It is applied at 29% of the wholesale value of wine.

Wine is taxed differently to other alcoholic beverages in Australia. It has its own tax, the Wine Equalisation Tax (WET).[1] The WET is imposed at the rate of 29 per cent on the wholesale value of wine.[2] All other alcoholic beverages are taxed on their alcohol content.[3] This generally makes the

The South Australian Wine Industry Association supports the Winemakers’ Federation of Australia proposals for change. Wine Equalisation Tax Rebate Submission

Wine Equalisation Tax (WET) is a tax on wine levied at 29% of the taxable value of wine. The taxing point is the last wholesale sale, or a retail sale or application for own use (e.g. tastings) when there is …

Wine equalisation tax rebate The Government has released exposure draft legislation and associated explanatory material that would amend the A New Tax System (Wine Equalisation Tax) Act 1999 to give effect to the reforms to the wine equalisation tax (WET) rebate announced on 2 December 2016.

BACKGROUND C ONTEXT The wine industry is an important contributor to the Australian economy, employing around 30,000 people directly and many more indirectly.

In the 2016-17 Budget, the Government announced that it will address integrity concerns with the wine equalisation tax rebate and better target support to small wine producers in rural and regional Australia.

BACKGROUND C ONTEXT The wine industry is an important contributor to the Australian economy, employing around 30,000 people directly and many more indirectly.

WINE TASMANIA SUBMISSION TO THE AUSTRALIAN GOVERNMENT…

Wine equalisation tax Wikipedia

Administration of the Wine Equalisation Tax